Strengthening your supply chain one link at a time.

Strengthening your supply chain one link at a time.

What is CPI?

The Consumer Price Index (CPI) is a monthly economic report from the Bureau of Labor Statistics. It is a metric that tracks what US consumers pay for goods and services. The CPI is a valuable indicator showing price trends that measure the rate of inflation. Inflation is the increase of prices over time which cause a loss of purchasing power.

The Bureau of Labor Statistics releases the CPI numbers once per month. These CPI numbers include the most recent month but also include revisions to the two previous months CPI numbers based on additional information such as seasonality.

The CPI has been a closely followed metric in recent years as price increases in the economy from Covid and post Covid forced the Federal Reserve to closely monitor and adjust policies to fight inflation. Not fighting the effects of sustained inflation would bring on increasing price increases and have negative impacts to the cost of living long term with prices of essential goods and services becoming increasingly more expensive over time. The macro effect would be an inevitable slowdown in the economy. In extreme cases some countries have experienced such high inflation that their currency becomes worthless.

CPI Historically

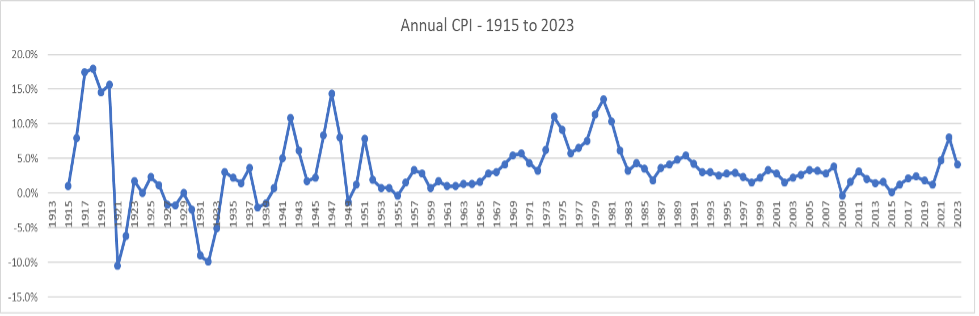

How does the current U.S. CPI compare to past years? In 2022 the annual inflation rate was 8% annually. 2023 the CPI was 4.1%. The chart below shows the annual CPI from 1915 to 2023. There were only five other periods since 1915 that had annual inflation of 8% or greater, 1917-20, 1942, 1946-48, 1974-75, and 1979-81. Covid clearly had an effect on inflation in 2022, just as the other past historical events caused the CPI to be high. 8% inflation in historical terms was a unique event.

How does the Federal Reserve contain inflation

The Federal Reserve uses certain policies to reduce the effects of inflation as measured by the CPI. One of the main policies is the influence on interest rates, which starts with the Fed Funds Rate. The Fed Funds Rate is the rate banks charge each other for overnight loans. These rates have a direct influence on all other loans or investments.

Higher interest rates have direct impact in the consumer choices in loans (mortgages, credit cards) and investments (CDs). Consumer choices are altered by increased interest rates. They change their habits and typically consume less because it costs more, and invest more in interest bearing investments because it might be a better alternative to other investments such as the stock market. Businesses also make decisions based on higher or lower interest rates. Long term capital projects might be delayed based on current and perceived future interest rates.

The goal of the Federal Reserve is to slow down the demand for goods and change inflationary expectations and, thus the resulting effect on prices. When the CPI shows that inflation is slowing the Fed will reduce the Fed Funds rates and interest rates for good and services will come down. But this will only occur by meeting the Federal Reserve criteria and goals. The goals of containing prices are based on the performance of the economy and prices as measure by the CPI.

CPI today

While stock market investors and the general consumer wait for interest rates and inflation to come down, the Federal Reserve monitors the most recent releases and revisions of the CPI. On February 13, 2024 the January CPI numbers were a monthly rate of 0.3%, or year over year at a rate of 3.1%. This annual rate came down from 3.4% in December. While this trend is good news is still does not meet the level of annual 2% inflation the Federal Reserve has indicated for targeted inflation. The Federal Reserve has also indicated it will be conservative in rate cuts to be sure that that inflation is being reduced. The CPI plays a major role for the Fed in identifying current and future interest rate policies as the Fed seeks to balance the cost of money (interest) with the changing cost of goods (inflation).

—Tom Schaefges, St. Onge Company