In part one of this blog series, “U.S. Tariffs – A History Lesson”, we provided a timeline of the creation of the international “Harmonized System”/HS and United States “Harmonized Tariff Schedule”/HTS as well as the organizations involved. As a refresher,

- HS is a multipurpose product nomenclature defining the international tariff/duties structure

- Developed by the World Customs Organization (WCO)

- Maintained by TATA (WCO’s “Office of Tariff and Trade Affairs Agreements”)

- HTS is a U.S. specific tariff schedule based off of the international HS, that lists the duty rate to be paid

- Developed and maintained by the USITC (S. International Trade Commission)

- The HTS was updated on 1/27/2022 based on TATA’s HS changes (on their 5-year schedule).

- The “U.S. Customs and Border Protection” agency uses the HTS to classify U.S. imports.

This final blog will summarize the United States’ HTS itself and how it impacts the U.S. companies.

Import/Export Tariff Codes

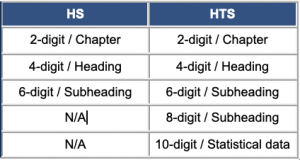

The WCO’s HS is consistent internationally for the import/export tariffs among all countries that use it. This accounts for about 98% of all international trade. The HS’ hierarchal structure starts at the top from the broadest article/product grouping down to the specific product description. As you dive deeper into the hierarchy, to the right of the HS code, 2-digit increments are added to further identify the product. Each product is only assigned one HS code. The HS hierarchy starts with 21 sections of similar product categories then divided into chapters.

There are 99 different chapter groupings which help narrow down the items in the section. The chapter is indicated by the first two digits of the HS code. Then 2 digits are added for the next level down, the “Heading” category. And finally, 2 more digits are added (totaling 6-digits) for the last level down, the “Subheading” classification. If needed, each country can subdivide this (up to 10 total) to further classify the goods. Any additional country specific classifications are unique to the importing country.

The U.S. did just that with the HTS, a “U.S. nomenclature system used to classify traded goods based on their material composition, product name, and/or intended function”. The first six numbers of the HTS are the same as the product’s HS code. The 8-digit classification is another “Subheading” and the 10-digit is used for trade data collection and statistical purposes. The table below shows the number of digits used for the HS and HTS classifications.

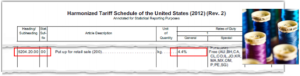

The United States classifies nearly every good that is imported, in a HTS 8-digit category. There are over 10,000 HTS 8-digit subheadings. See the HTS example below where the 8-digit classification for imported “cotton sewing thread put up for retail sale” is 5204.20.00 and its general rate of duty is 4.4%. The USITC’s E-learning course advises how to properly read it and HTS info provides more information.

In addition to the WCO’s HS being used for U.S. imports, the U.S. Census Bureau uses it as the basis for their U.S. export “Schedule B”. The Schedule B is closely aligned with the HTS. Shippers must only use the Schedule B numbers for export shipments where the Schedule B numbers are listed in the HTS’ “Notice to Exporters” section. Otherwise, shippers can use either the HTS or the Schedule B codes for exports. This allows you to compare U.S. export data with another country’s import data at the international 4-digit or 6-digit level.

Your Internal Setup

Companies with an import/export compliance program managing the proper coding and their maintenance processes are in a good spot. To ensure compliance, companies should also consider the following system setup; designated fields in your item and material master tables, auto-populating the appropriate customs paperwork, and auto-transmitting timely to the appropriate parties and systems.

How U.S. tariffs impacts to your Supply Chain

The HS allows countries to collect the duties to which they are legally entitled and to prevent illegal international trade. In addition, the U.S. uses HTS codes to track products to prohibit illegal or dangerous items (i.e. contaminated food) from crossing into the U.S. So how do these U.S. tariffs (HTS codes and Schedule B codes) affect U.S. importers and exporters?

- Companies smuggling illegal goods or paying incorrect duties may sell them at a lower price than their competitors. This unethical practice disrupts the market.

- The public may distrust companies who don’t use the HTS standard which can decrease the demand for their products.

- Using the HTS simplifies companies’ duty payments so they can focus on their operations and core competencies which in turn will improve productivity.

- Where products are incorrectly coded and/or don’t comply, companies could be subject to additional inspections, increases in audits, fines, and ultimately import / export bans delaying customer shipments.

Basically, the HTS safeguards your productivity, profit, and customer satisfaction.

———————————————————————————————————————————-

Stay tuned for more blogs that continue to explore the transportation industry and systems.

–Jess Kittrell, St. Onge Company